amazon flex tax form download

More than 20000 in unadjusted gross sales and. Due to Internal Revenue Service IRS regulations US third-party settlement organizations and payment processors including Amazon are required to file a Form 1099-K for US taxpayer sellers who meet the following thresholds in a calendar year.

How To File Self Employment Taxes Step By Step Your Guide

FREE Shipping by Amazon.

. Click the Download PDF link and enter the password. Pick up products food electronic apparels or anything else that can be ordered on Ain or its allied apps and sites from an Amazon delivery station and deliver directly to customersDelivery blocks are typically 2-6 hours. Click the Amazon Flex app.

Xiaomi Redmi battery device settings. Report Inappropriate Content. 710357898 64-bit 32-bit Safari.

For your security your tax form is password protected. The 153 self employed SE Tax is to pay both the employer part and employee. Self-employment taxes include Social Security and Medicare taxes.

The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. The Amazon Flex app gives you access to technology that makes delivering packages easy.

You pay 153 SE tax on 9235 of your Net Profit greater than 400. Pick up groceries or household items from an Amazon delivery station and deliver directly to customers. 12 tax write offs for Amazon Flex drivers.

Disable the settings for Freeze when in background and Automatically optimize when an abnormality is detected. Hover over your email address displayed in the top right corner and select Account Settings. Youll also pay income taxes according to your tax bracket.

Actual earnings will depend on your location any tips you receive how long it takes you to complete your deliveries and other factors. More than 200 transactions. This video shares information on where to find your 1099 expenses you should take into account to reduce your taxable i.

If you join us you can build your own. Sign out of the Amazon Flex app. 45 out of 5 stars.

Download Files can be accurately viewed only on following versions or higher. FilingPaying Self-Employment Taxes. Fill out your Schedule C.

Get it as soon as Fri Jun 3. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400. Driving for Amazon flex can be a good way to earn supplemental income.

To access a digital copy of your form please follow these steps. Select Sign in with Amazon. Amazon Flex quartly tax payments.

Amazon Flex drivers are independent contractors. Sign in using the email and password associated with your account. Or download the Amazon Flex app.

With Amazon Flex you work only when you want to. Most people pay 153 in self-employment tax. If you still cannot log into the Amazon Flex app please contact us at 888-281-6906 daily between 8 am.

We know how valuable your time is. 6040esr 64-bit 32-bit Chrome. You can plan your week by reserving blocks in advance or picking them each day based on your availability.

Most Amazon Flex delivery partners earn 18-25 per hour. 1112 11605381 Internet Explorer. Whatever drives you get closer to your goals with Amazon Flex.

Go to Settings Battery. Income tax starts at 20 on all your income not just from amazon over 12500 and 40 over 50000. Gig Economy Masters Course.

Get it as soon as Thu Feb 3. Amazon is a multibillion-dollar Goliath but even they make occasional mistakes. Your 1099-NEC isnt the only tax form youll use to file.

Increase Your Earnings. To save the form to your computer while it is open in Adobe Reader click File. If you earn at 600 per tax year driving for Amazon Flex expect a 1099-NEC form in the mail from them by late Januaryearly February of the.

ITIN Document Download Click the Download button to download the document. If Amazon didnt issue you a 1099-K form contact Seller support. Amazon Flex Drivers are considered 1099 non-employee workers which is a separate taxpayer status from the classic W-2 salaried employees who work for someone.

You can plan your week by reserving blocks in advance or picking them. To make sure you do this right just look through your bank statements and add up your direct deposits from Amazon Flex. Class 2 National Insurance is paid as a set weekly.

1099 MISC Forms 2021 4 Part Tax Forms and 25 Self-Seal Envelopes Kit for 25 Individuals Income Set of Laser Forms - Designed for QuickBooks and Accounting Software 2021 1099 Tax Forms. Log in to Amazon Associates. Click Download to download copies of the desired forms.

Knowing your tax write offs can be a good way to keep that income in your pocket. And finally downloadprint your 1099-K for the year. That means you have to pay self-employment tax.

Well guide you every step of the way from sign up to making your first delivery to on-road support. Then the appropriate year and then Form 1099-K. What if my 1099-K form is inaccurate or I didnt receive one.

Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone. How to Calculate Your Tax. Unlike a W-2 employee Amazon doesnt pay half of your self-employment taxes.

From there select the Tax Document library. Self Employment tax Scheduled SE is automatically generated if a person has 400 or more of net profit from self-employment. Tap Forgot password and follow the instructions to receive assistance.

Its almost time to file your taxes. Choose the blocks that fit your schedule then get back. Adjust your work not your life.

The amount of tax and National Insurance youll pay will depend on how much money is left over after deducting your flex expenses tax allowances and reliefs. With Amazon Flex you work only when you want to. Blue Summit Supplies 1099 NEC Tax Forms 2021 50 4 Part Tax Forms Kit Compatible with QuickBooks and Accounting Software 50 Self Seal Envelopes Included.

Click ViewEdit and then click Find Forms. We would like to show you a description here but the site wont allow us. Delivery is easy with the Amazon Flex app.

Unfortunately youll still have to report your income to the IRS even without a 1099. Most drivers earn 18-25 an hour. Go to Settings Battery.

4pcx Melamine Sponge White Magic Sponge Eraser Eco Friendly Kitchen Magic Eraser Kitchen Magic

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

How To File Self Employment Taxes Step By Step Your Guide

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

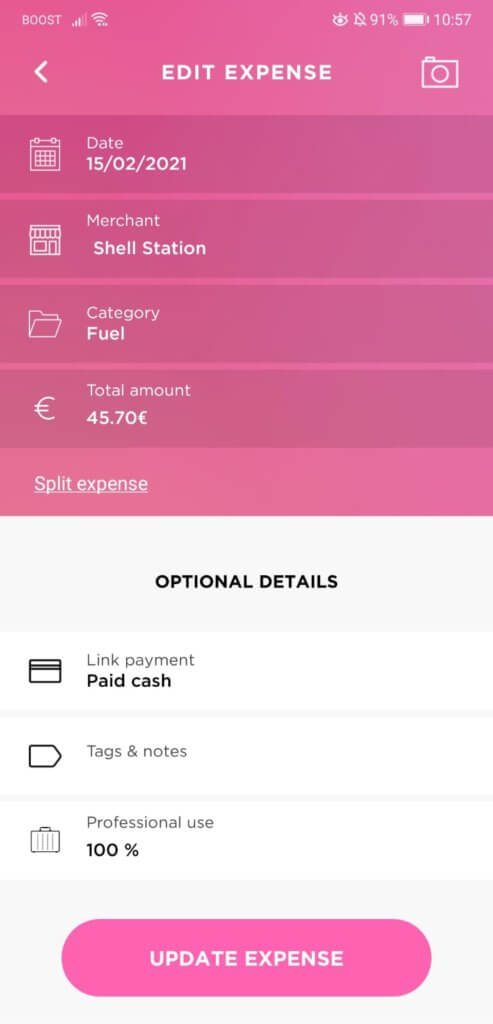

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Amazon Merch Tax Time How To Download Your 1099misc Form From Amazon Merch Youtube

9 Ways To Keep More Of Your Money As A Rideshare Driver This Tax Season

Turbotax Lyft Reporting Your Rideshare Driver Income On Your Taxes Webinar Youtube

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

![]()

Irs Uber Mileage Log Tax Deduction With Triplog Tracking App Tax Deductions Tracking App Mileage

How To File Self Employment Taxes Step By Step Your Guide

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable